49+ can you deduct rental property mortgage payments

Web A benefit of mortgage default insurance is that youll likely receive better mortgage rates in Canada. Get an Expert Opinion2nd Opinion.

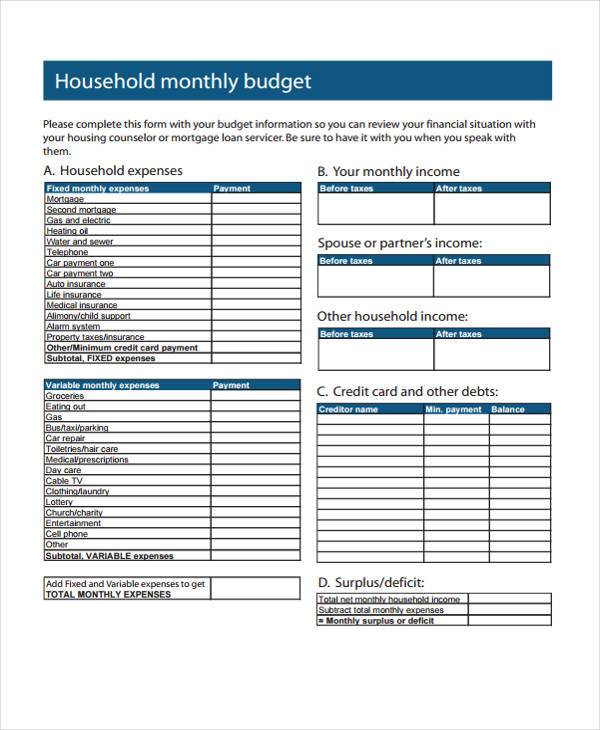

49 Sample Monthly Budgets In Pdf Ms Word

Ask Online Right Now.

. Free Edition tax filing. All online tax preparation software. - SmartAsset The IRS does not permit rent deductions.

The same goes for property or on-site managers should you choose to hire one. Web You cannot deduct principal mortgage payments from your income whether your real estate property is your primary residence or a rental property. In this case 1012.

Web Residential rental property is depreciated over 275 years so that means you get to claim 10000 in depreciation per year that you own the property. However if you are self-employed or a business you might be. Deluxe to maximize tax deductions.

Premier investment rental property taxes. Web You need to add the asset rental property into the 1065 partnership return so it can be depreciated. Ask Certified Tax Pros Online Now.

Web If you only rent out the property 10 months of the year say you can only deduct a fraction of the mortgage interest. Ad Get Personalized Answers to Tax Questions From Certified Tax Pros 247. When you add the asset you will also add the loan.

Web Taxpayers must recover the cost of rental property through an income tax deduction called depreciation. However if you prepay the premiums for more than one year in advance for. Web Key Takeaways.

Common tax-deductible interest expenses. There are many tax benefits of owning a rental property including a depreciation deduction mortgage interest deduction as well as other. Web As a rule of thumb a rental property owner can deduct interest payments made to acquire or improve a rental property.

Resolve Tax Problems w Professional Help. Losses If you meet the IRS definition of. Web If you hire someone else to do the work you can deduct the labor costs.

In general you can deduct mortgage insurance premiums in the year paid. Web Compare TurboTax products. Ad Get Streamlined Access and Unlimited Legal Questions.

You can pay a minimum 5 down payment on the first. This annual allowance accounts for a propertys wear. Dont Take Chances w the Law.

Web Can You Deduct Rent on Your Taxes.

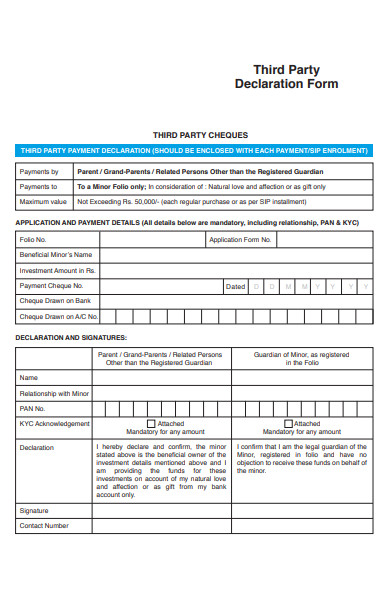

Free 49 Party Forms In Pdf Ms Word Excel

Top 12 Rental Property Tax Deductions Benefits Free Worksheet

Is Your Mortgage Considered An Expense For Rental Property

Sgd Inr Crosses 50 Aditya Ladia

Buy To Let Mortgage Interest Tax Relief Explained Which

What Is The In Hand Salary If Ctc Is 12 Lpa And Opted For A New Regime Quora

Top Tax Deductions For Second Home Owners

Can You Write Off Loan Payments From A Rental Property

Sgd Inr 50 With Sg 50 Aditya Ladia

Can You Write Off The Difference Between The Rent Collected Mortgage Paid

Solved Consider The Buy Vs Rent Excel Spreadsheet Chegg Com

:max_bytes(150000):strip_icc()/house-keys-and-contract-on-table-in-house-rental-1082558850-f4ceefa00b2f4b08b84c4ae77d17dd65.jpg)

The Tax Benefits Of Owning A Rental Property

Is Your Mortgage Considered An Expense For Rental Property

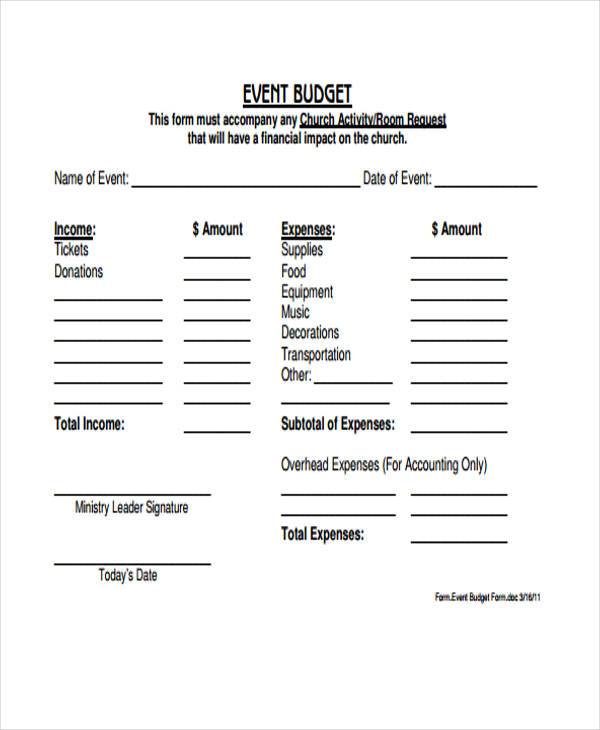

Free 49 Budget Forms In Pdf Ms Word Excel

Free 49 Budget Forms In Pdf Ms Word Excel

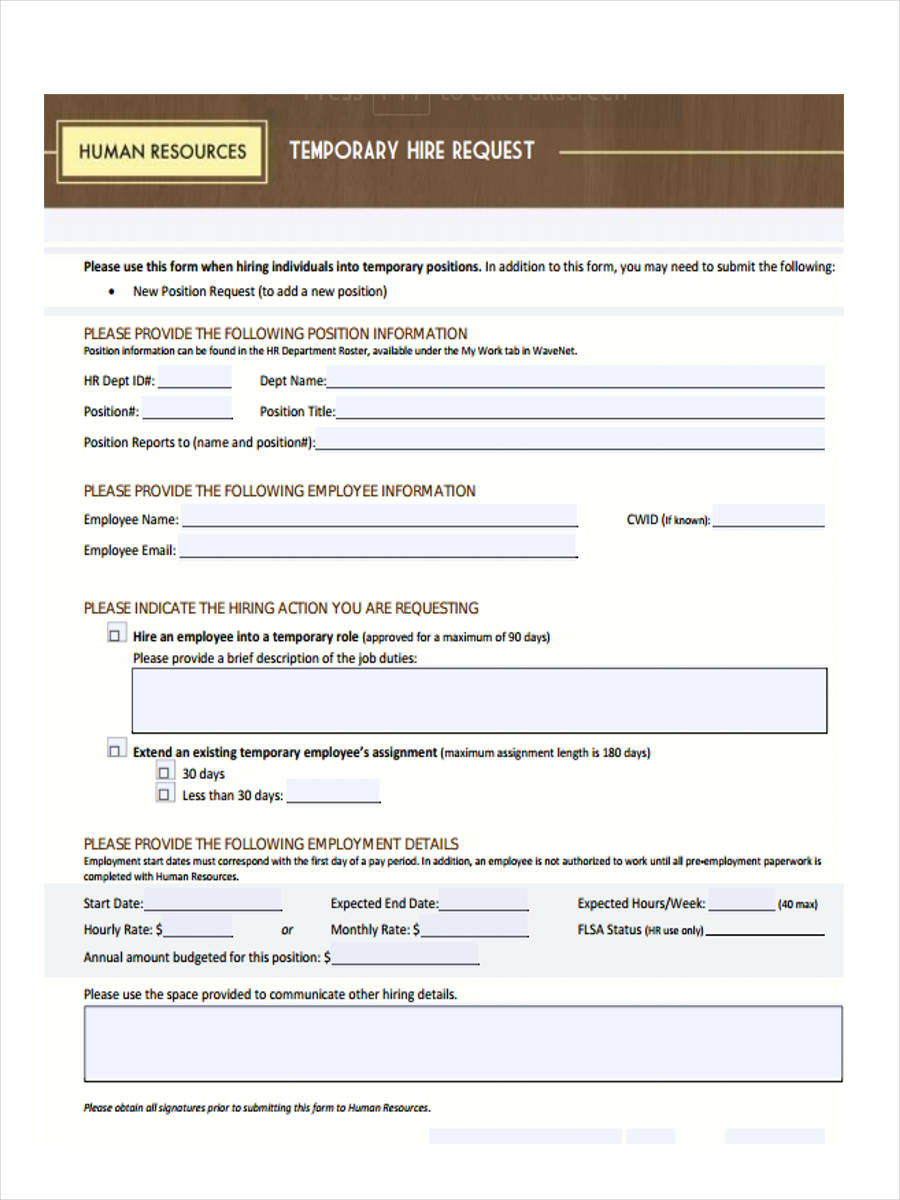

Free 49 Sample Employee Request Forms In Pdf Ms Word Excel

3 Bhk Flats In Ranchi From 40 Lakhs To 45 Lakhs 49 3 Bhk Apartments Flats For Sale In Ranchi Below 45 Lakhs